The Challenger Customer:

Understanding Mobilizers, Talkers, and Blockers

Challenger research revealed that high-performing reps win by working with one particular customer profile – and working around others. Learn more about the Challenger customer.

What drives the most loyalty among B2B buyers?

It’s not your awesome product and stellar service.

It’s not the strength of your brand.

And it’s not price.

More than half of B2B buyers revealed that what buys their loyalty is their sales experience — and the most successful sellers – Challengers – live and breathe this approach to sales. They know how to identify and each type of stakeholder to guide a complex purchase process forward. By identifying the Challenger customer, they effectively build consensus and move even the most complex deals across the finish line.

So, who is this sought-after buyer? The Challenger customer isn’t always agreeable, but they are the buyers most likely to help you win a complex sale. Seeking them out is incredibly important for sellers, given what we’ve learned about the importance of the sales experience to customer loyalty.

When CEB (now Gartner) conducted a widescale study of approximately 5,000 individuals to determine what exactly they look for in B2B suppliers and solution providers, they found the sales process was the only dimension where buyers truly perceived a difference. In this study, 53% of buyers cited the sales experience — more than brand, service delivery, and value combined.

This factor drives more customer engagement and loyalty than brand, reputation, service, quality, and price combined. A high-quality product, a great brand, and reasonable pricing are merely table stakes. Our 2019 B2B Buyer Study revalidated this finding and further identified what they wanted most in customers. “Demonstrating unique insight,” “helping me come to a decision,” and “understanding and addressing different stakeholder needs” were the top skills buyers wanted from sellers. In a 2024 study, LinkedIn and Ipsos found that buyers most wanted sellers to “demonstrate a clear understanding of [their] business needs,” and “demonstrate a clear understanding of [their] industry/competitors.”

The B2B buying process was never easy. Growing stakeholder groups and elongating sales cycles make it feel as though we add a new layer of complexity by the day. Buyers now have more choices and research tools and less interest in interacting with sellers. Sellers must fight for a smaller portion of buyers’ mindshare and time. Our research shows that high-performing reps win despite these obstacles because they understand both the changing nature of B2B buying groups and the role of individual stakeholders. Let’s dive into what the research reveals about these individual stakeholders and how Challengers effectively mobilize them to close complex deals.

The growing buying group’s role

Our interest in customer behavior dates back to the study that inspired 2011’s “The Challenger Sale.” In that book, authors Matt Dixon and Brent Adamson wrote, “In order to really understand what drives sales performance, you have to consider what drives customer behavior.”

Let’s start with the example of a typically complex purchase process that often ends in no decision.

In 2019, CEB (now Gartner) found that buyers identify 89% of all business problems without supplier input. These customers name the need through internal analysis or a third-party source of information and then respond to the problem as they see it.

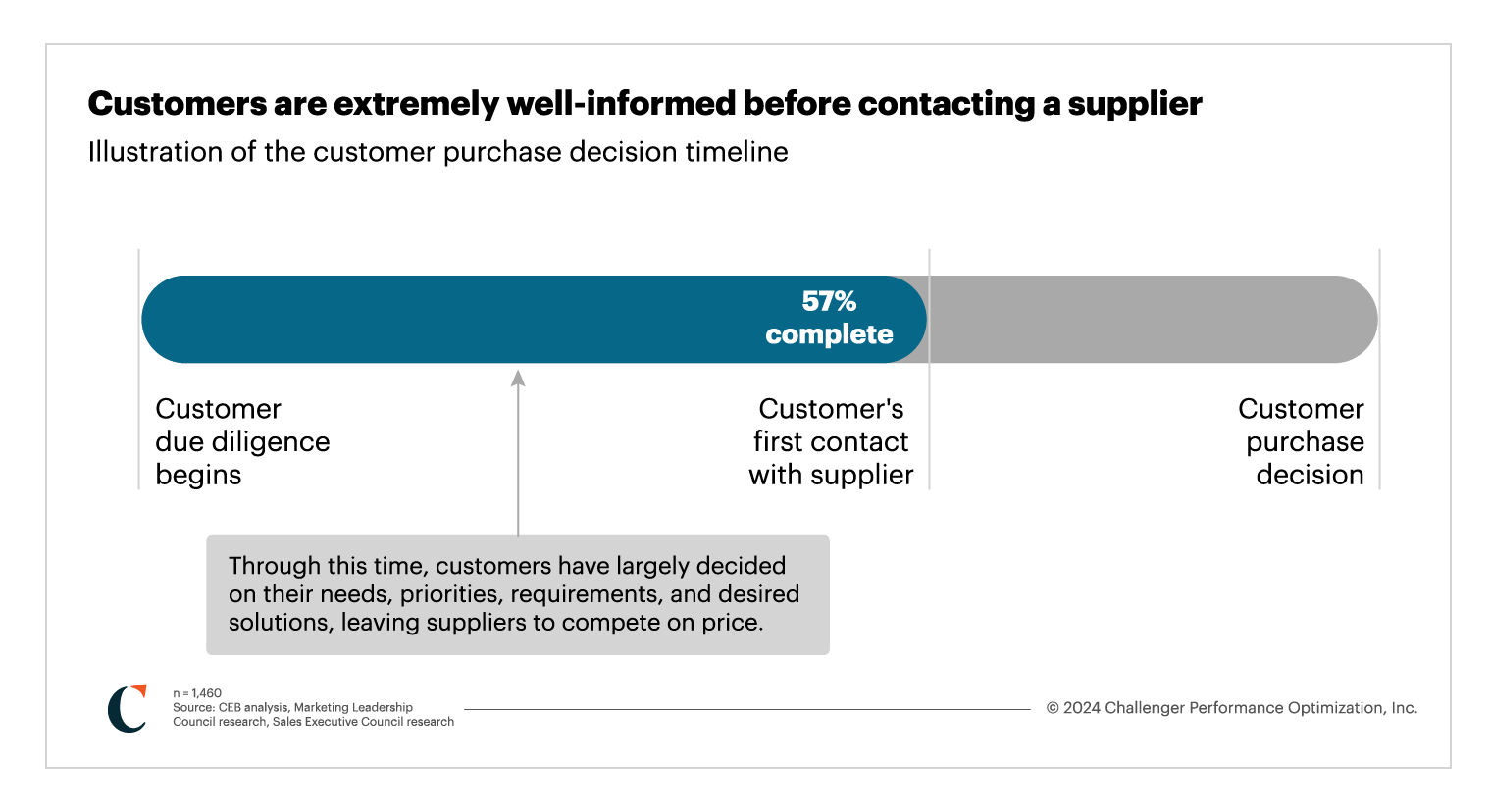

Next, they call together a committee. This group is, on average, about 11 people, and in complex deals, may be as many as 20. They embark on a multi-month exploration, including identifying the suppliers they think could solve their problem. When they are 57% of the way through that journey, they finally engage with vendors.

That engagement is relatively short. The buying group spends only 17% of its time with all vendors combined. In this environment, the buyer’s constraints limit the vendor’s role. After all, it was the buyer who identified the problem, the buyer who assembled this steering committee, the buyer who cast a net, and the buyer who set the criteria.

The real kicker here is that, after all that work, about one-third—38%, to be exact—of these purchase attempts end in no decision. While a full explanation of those results requires a deeper look into the factors driving no-decision losses, customer behavior and buying group size certainly play an important role.

These results frustrate sellers, as they know they were never driving the proverbial bus. Sales leaders can’t possibly construct an accurate forecast from a pipeline full of this type of complex sale. Worst of all, this sales process is long and painful for customers, a fact made even worse by its high chance of failure.

And that’s significant because the original Challenger research, validated again in 2019, shows that sales experience is still the biggest driver of customer loyalty. With that in mind, sellers must ask: If I’m getting less time with the customer, how do I ensure I deliver the right experience to drive loyalty?

To start, we must understand where the typical purchase process goes wrong – and how finding the correct type of Challenger customer stakeholder makes all the difference.

Understanding Challenger customer types

What factors define a great working relationship? Maybe a supervisor listened to you and respected your perspective, even when it differed from their own. Perhaps you bonded with a coworker with whom you shared long-term goals. In each instance, you worked with someone who didn’t take you at face value, but pushed you to grow. They probed deeper, asked uncomfortable questions, and challenged you. We know this is the kind of working relationship (and frankly, the kind of anything relationship) that pushes us to our biggest achievements.

In the “The Challenger Customer,” authors Matt Dixon, Brent Adamson, Pat Spencer, and Nick Toman set out to uncover what Challengers look for when building successful relationships with customers.

About the analysis

- 700 customer stakeholders across hundreds of organizations

- Customers were asked to assess themselves across 135 different stakeholder attributes, traits, and perspectives

- Objective was to identify profiles and determine how likely each type of customer was to drive concrete action around a large-scale corporate purchase or initiative

Using a process called factor analysis, they grouped customers into seven distinct customer profile archetypes.

The Go-Getter

This profile adeptly drives change because they want to champion ideas that generate business results.

The Teacher

This profile effectively paints a vision that builds momentum for new ideas.

The Skeptic

This profile carefully examines the details and then pushes for change in bite-sized increments.

The Friend

Though this person always takes your call, they rarely buy. They’re likely extending that hand of friendship to other vendors – and they can easily waste your time.

The Guide

This person shares information but lacks the influence to drive actual change.

The Climber

This person backs out at the first sign of reputational risk. Sellers also find that this person is distrusted by coworkers who assume they have an outside agenda.

The Blocker

This person believes stability is the goal and casts a wary eye at any change.

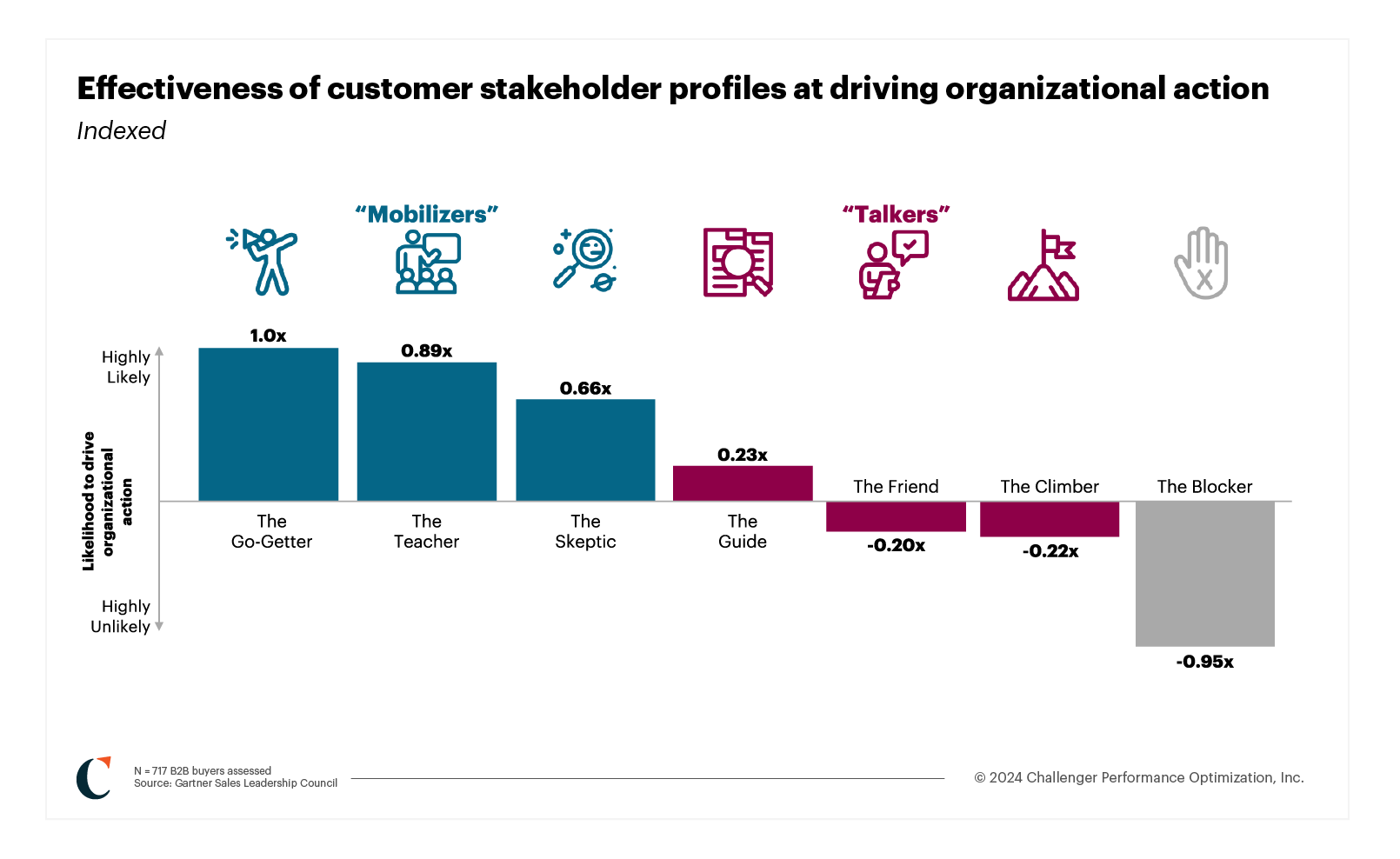

The researchers then zoomed in on the attributes sales reps seek when prioritizing one customer stakeholder over another. For star performers (i.e., Challengers), two customer characteristics stood above the rest: the ability to drive change across their organization and build consensus among their colleagues. But which profile did this best?

This question helped them split these customer archetypes into three categories – Mobilizers, Talkers, and Blockers.

Mobilizers

Challengers know to target these buyer profiles because they move their organizations toward consensus and build a framework for change. They’re vendor-neutral, curious, and sometimes even skeptical.

Talkers

Core-performing reps target these buyer profiles because they make it easy. Finding and engaging these contacts takes as little as one email or phone call. They like to share information, take meeting requests, and understand how your product will help them. Unfortunately, they can’t drive large-scale organizational change.

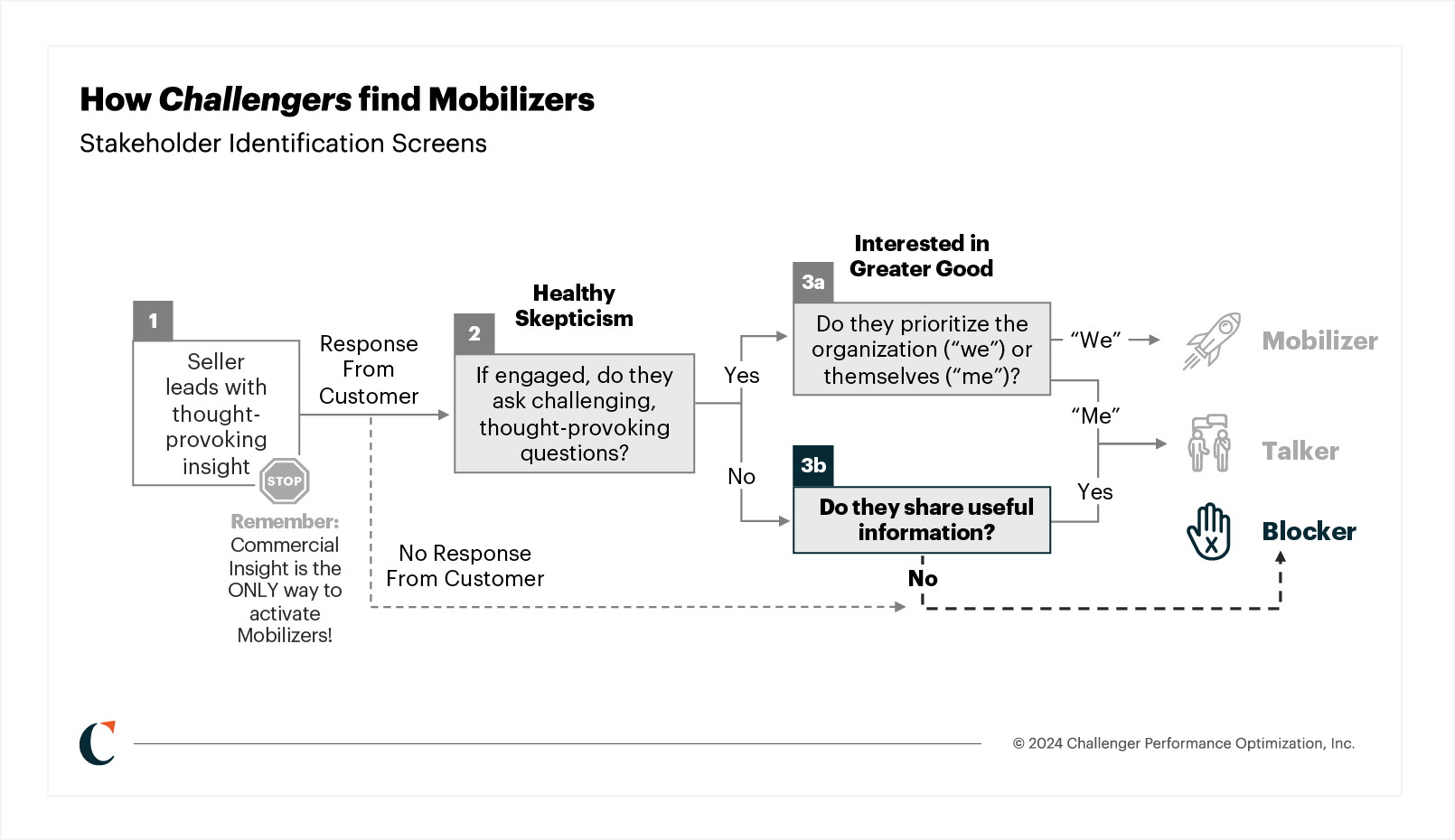

Blockers

Blockers rarely help vendors and may even hinder the deal’s progress. Sellers must understand how to handle and avoid Blockers.

Challengers know identifying a Mobilizer is the first step to wrangling an unwieldy buying group. So, how do they weed out Talkers and ensure they’re focusing efforts on the right stakeholders?

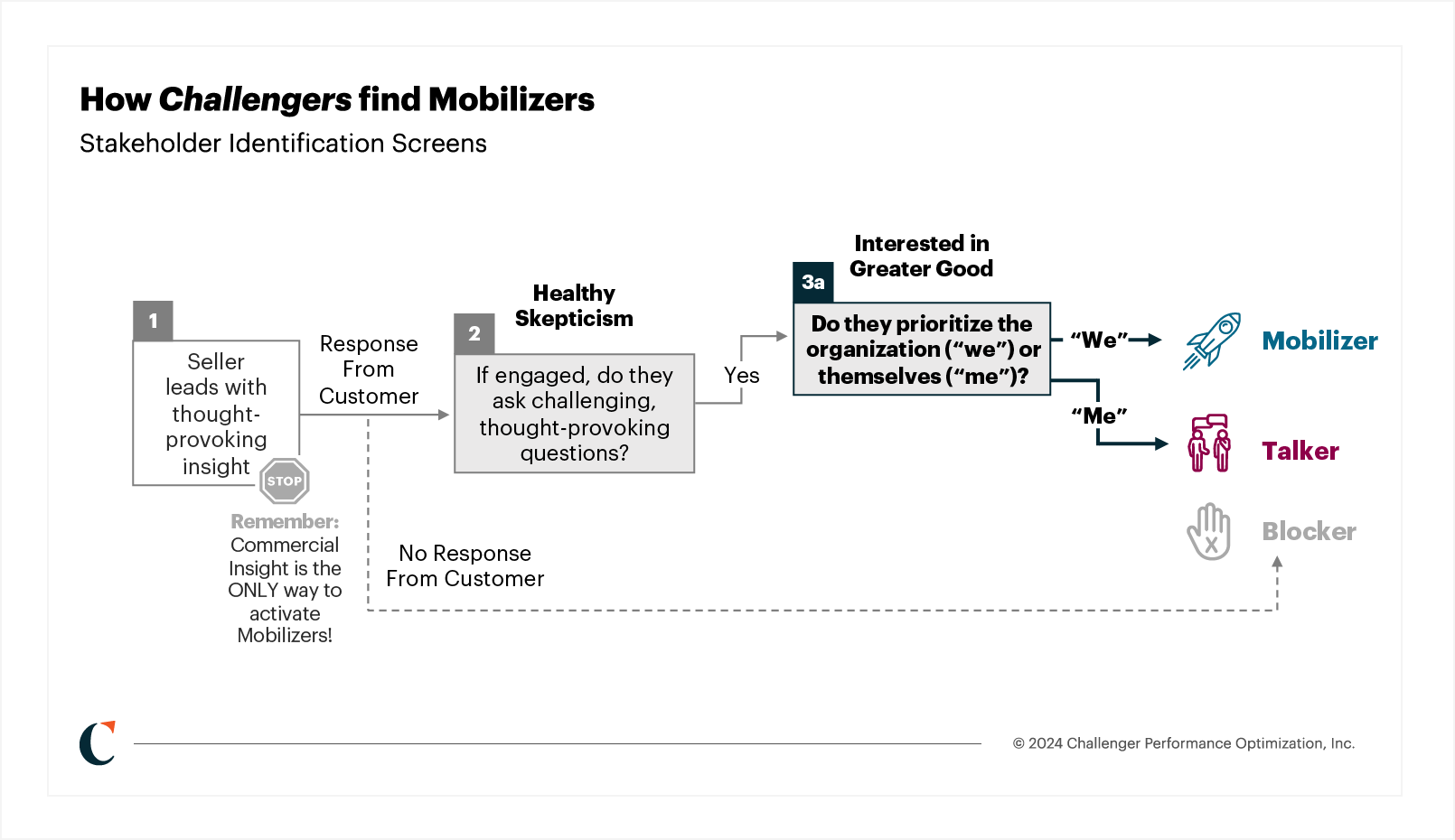

How to identify a Mobilizer

Research by CEB (now Gartner) published in “The Challenger Customer” tells us that sellers who target Mobilizers are 31% more likely to be high performers. So, how do you find and engage a Mobilizer – and ensure your key contacts aren’t do-nothing Talkers?

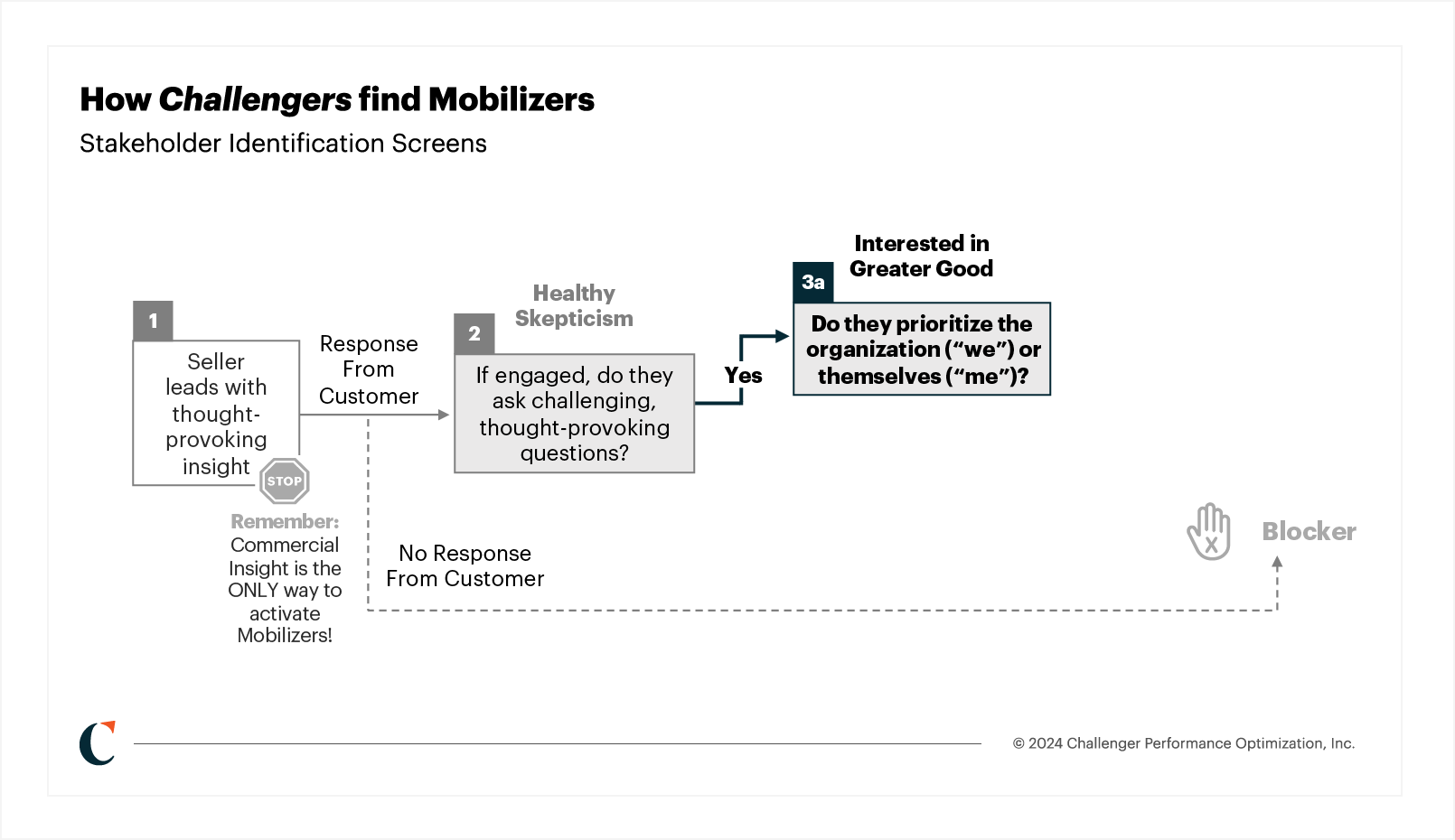

It starts with a Commercial Insight. Sellers find Mobilizers at every level of an organization, so the customer’s reaction to Insight delivery, rather than their title, indicates their status as a Mobilizer. When Mobilizers hear new information, they don’t just nod and smile. They respond with healthy skepticism. They ask thought-provoking questions. They might even irk you – they’re the person saying, “Those numbers seem overblown,” or asking, “What can you tell me about this study’s methodology?” Mobilizers often narrow in on the relevance of Insights to their organization. They think in terms of “we,” and their questions reveal they’re thinking about the collective.

- They work hard to pressure test what sellers tell them.

- Their coworkers respect them and provide them with access. They can make introductions.

- They speak in terms of “we,” not in terms of “I.”

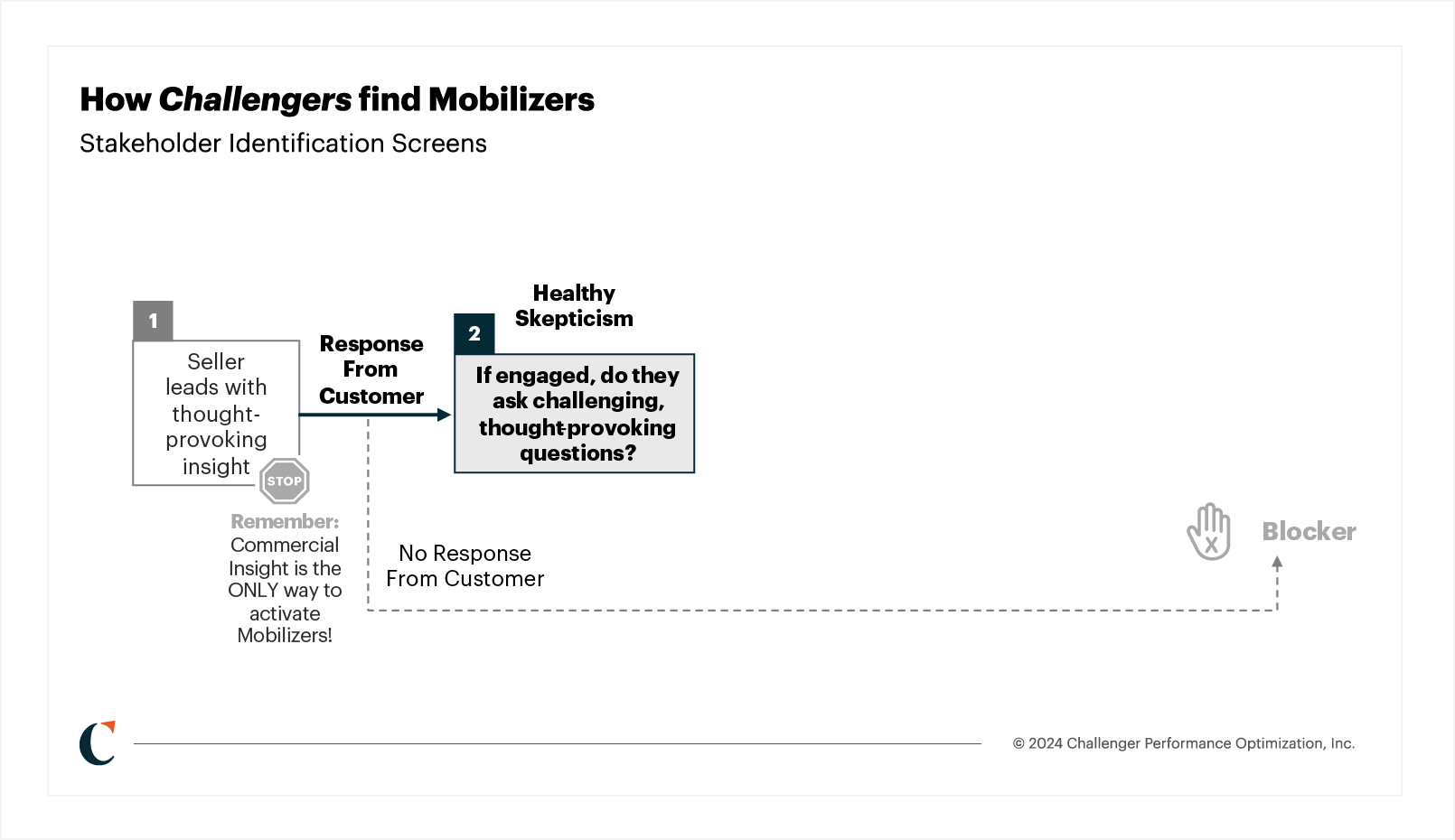

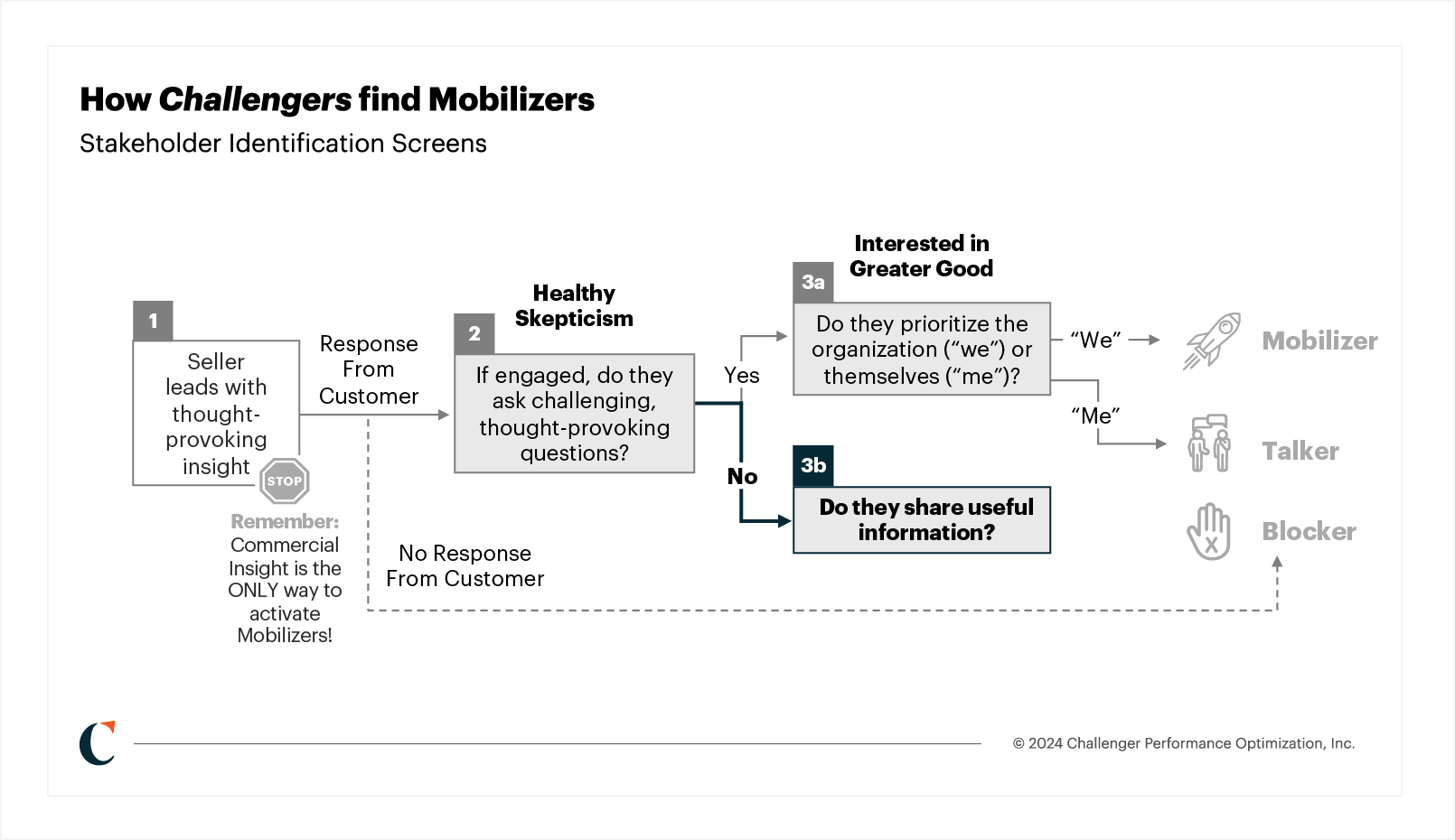

Here’s how it might look to screen a stakeholder for Mobilizer status.

What this looks like with a Mobilizer

- The seller leads with a thought-provoking insight – the only way to activate a Mobilizer.

- The customer responds with healthy skepticism. They’re engaged and ask challenging, thought-provoking questions.

- They ask questions revolving around “we,” not “I”

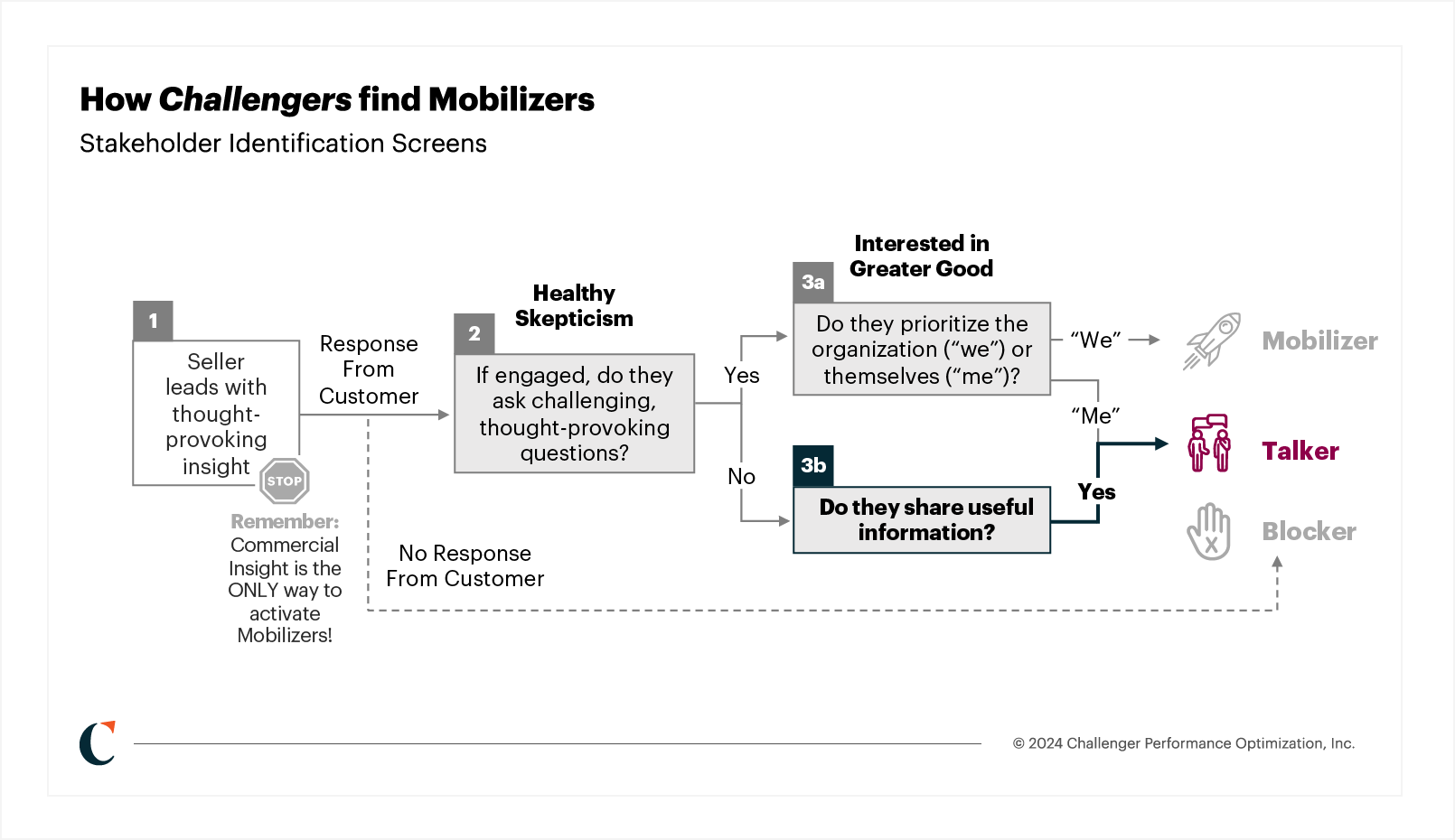

How this looks with a Talker

- The seller leads with a thought-provoking Insight – the only way to activate a Mobilizer.

- The customer engages, but doesn’t ask any thought-provoking questions.

- The customer shares useful information with the seller

Or…

- The seller leads with a thought-provoking Insight – the only way to activate a Mobilizer.

- The customer responds with healthy skepticism. They’re engaged and ask challenging, thought-provoking questions.

- But their questions revolve around “I,” not “we.”

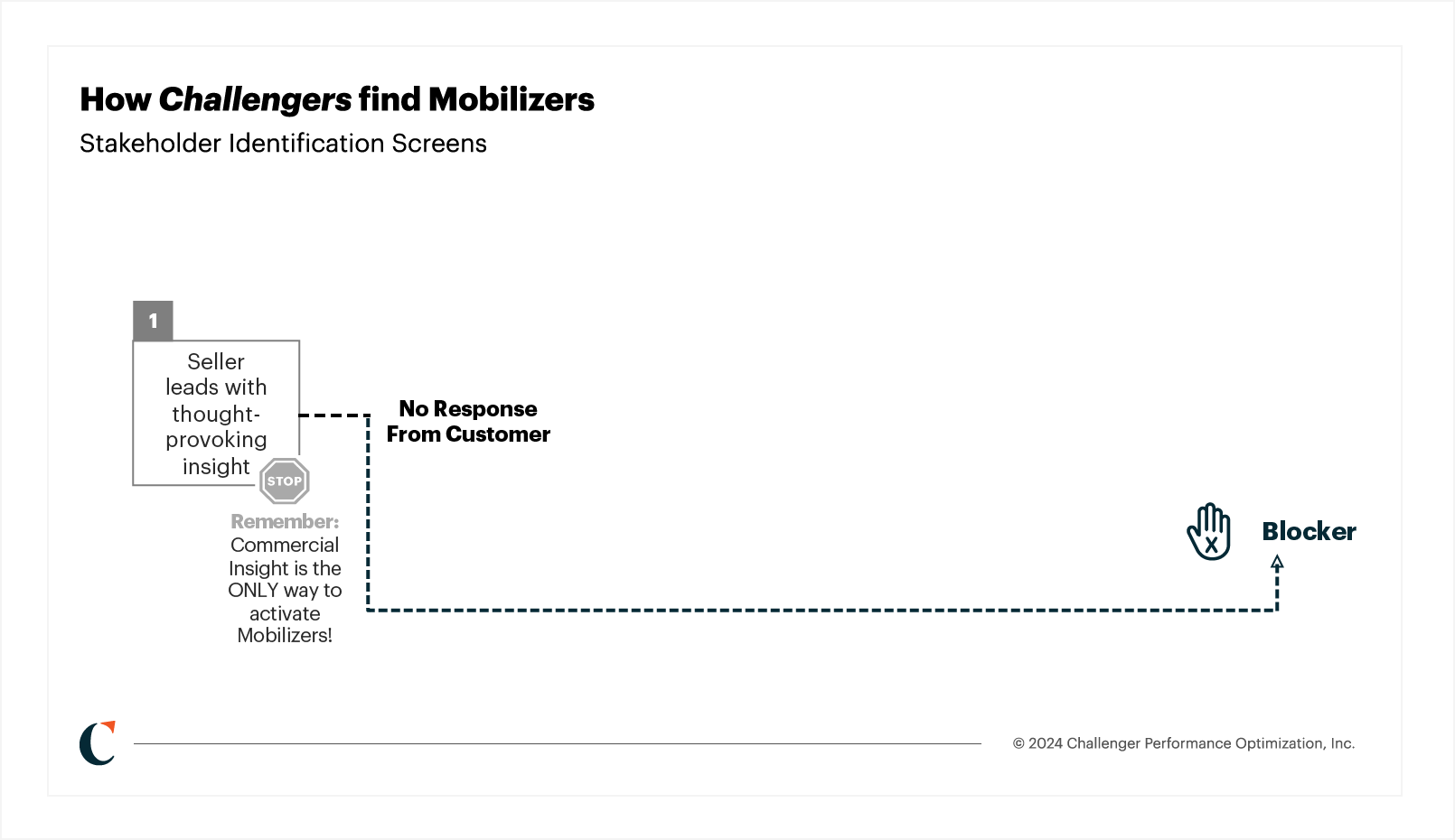

How this looks with a Blocker

- The seller leads with a thought-provoking Insight – the only way to activate a Mobilizer.

- The customer seems bored or disinterested. They don’t ask any questions.

- They don’t offer any useful information.

With their Mobilizer confirmed, the seller’s partnership in moving the buying group toward consensus begins.

Coaching the Mobilizer toward a close

Mobilizers are the key to unlocking organizational consensus on a purchase decision. When working with them, Challengers focus on a different set of behaviors than core performers.

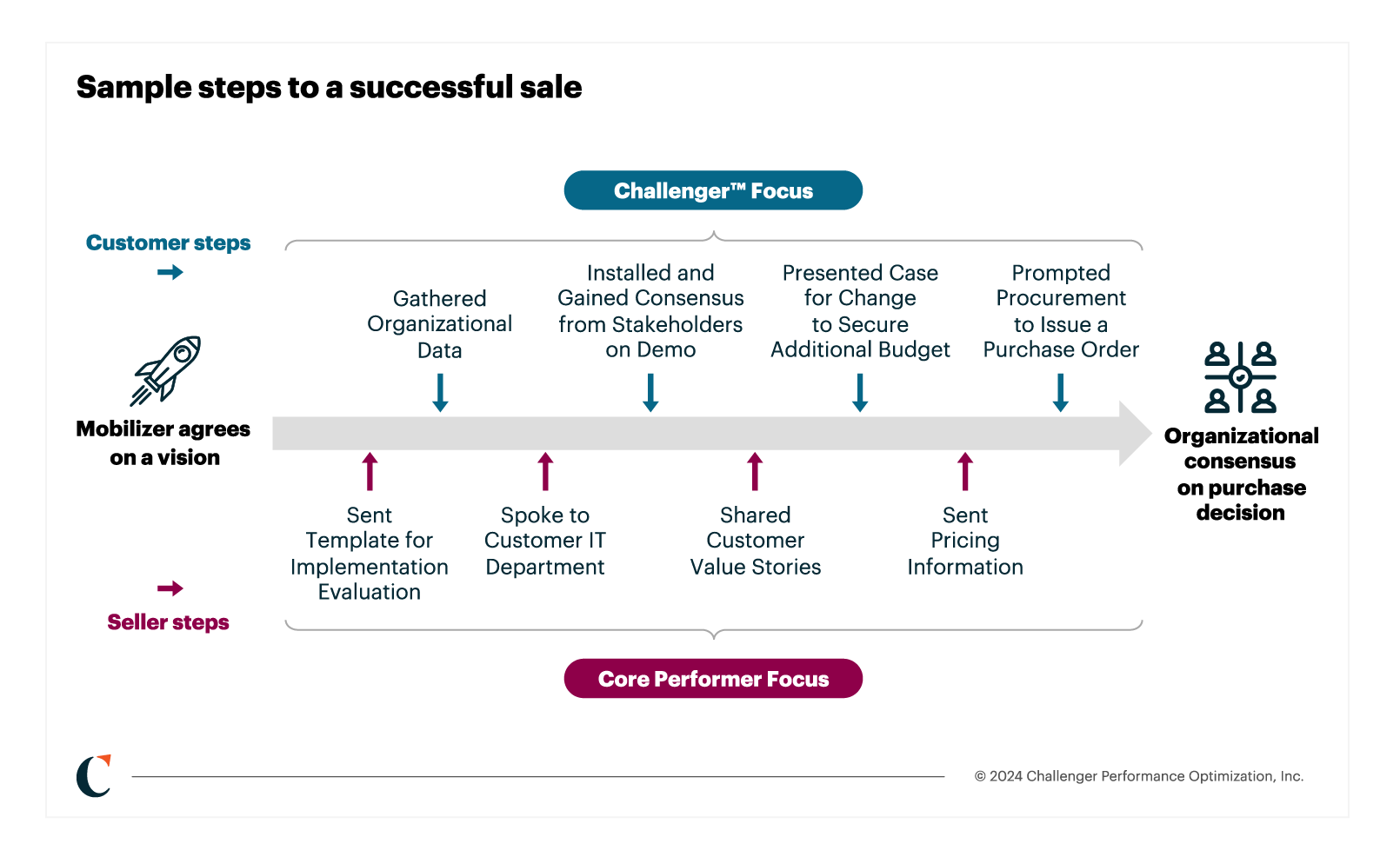

- Core performers focus on their own behaviors – sending an implementation template, performing the demo, delivering pricing information, and filling out the purchase order. They use their own progress on these actions to determine progress toward a close.

- Challengers understand that gaining consensus requires focusing more on the customer’s behaviors. They pay attention to whether the customer asked questions about implementation, gained consensus from stakeholders on the demo, presented a case for change to secure the required budget, and prompted procurement to issue the purchase order. These steps indicate that a Mobilizer is working with a seller to move the deal forward.

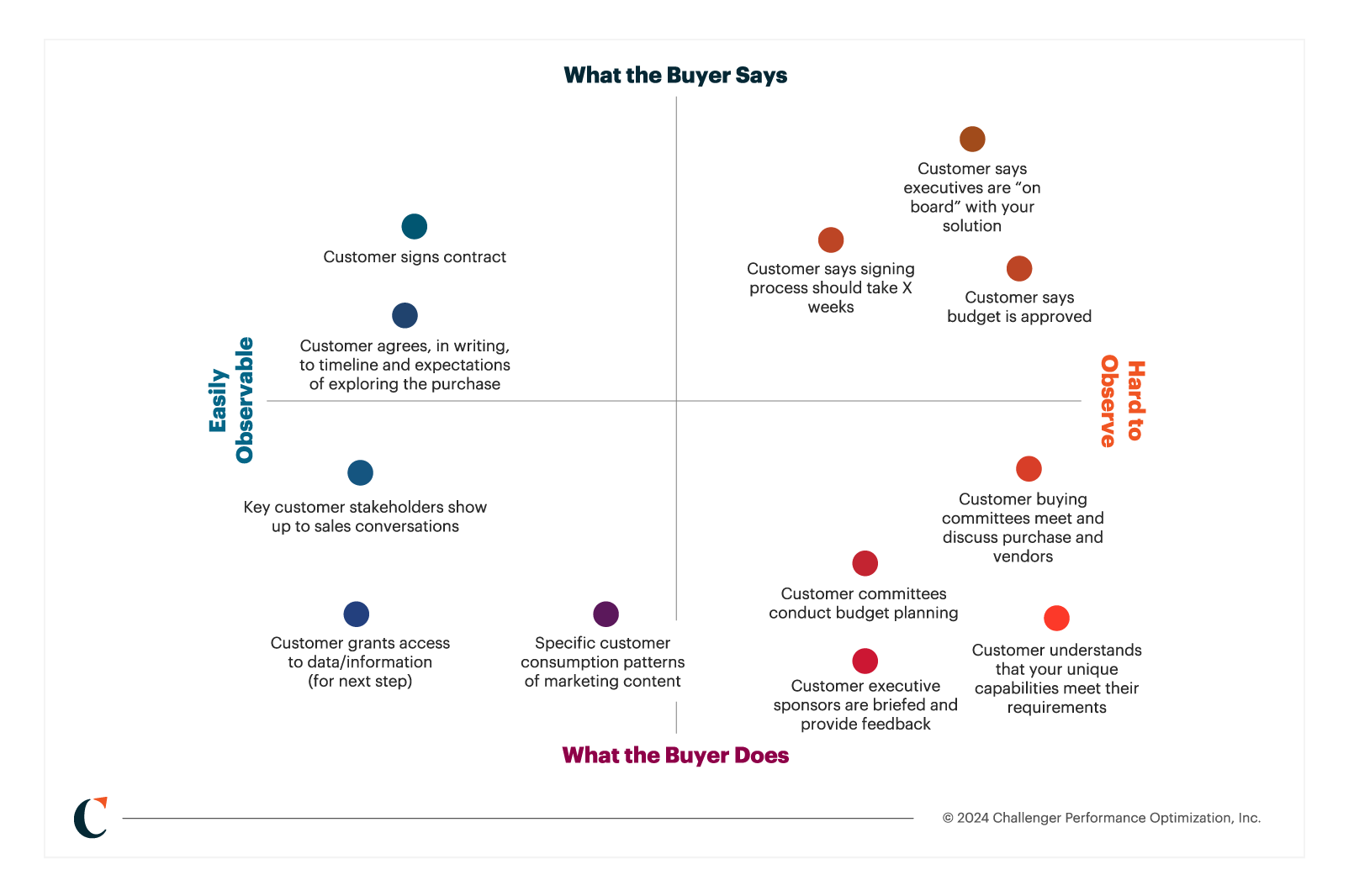

The steps may achieve the same result, but the shift in focus allows Challengers to read between the lines and identify missed steps that signal whether a Mobilizer is building consensus toward a purchase decision. Yet, Challengers know that often isn’t enough, especially when their quota is on the line. They understand that a gap between what they can see and what’s happening within a large buying group can be vast.

When they need more information from their Mobilizers, they turn to Powerful Questions. This means going beyond the status quo questions to dig deeper, ask for more specificity, and even ensure customers (who may be new to a complex sales process) have considered all potential blockers to a sale. This is the key to closing the gap between what customers tell you and what customers do, so you can predict the outcome more accurately.

Powerful Questions that sellers ask their customers:

- “Does [exec sponsor] have a clear understanding of the ROI of this investment?

- “Typically, our clients need CFO approval for a purchase of this size. Is your CFO aware of this investment?”

- “In order to begin on time, we need to finalize the agreement by XX date. Are your procurement and legal contacts aware of that deadline, and are they committed to meeting it?”

Challengers know they must sometimes help their Mobilizers wrangle a buying group, think through purchase steps, and point out potential hurdles. We call this Commercial Coaching, and it marks a crucial difference between the approach core performers take – where the customer teaches the seller about the ins and outs of their organization – and the approach Challengers take – where the seller arms a Mobilizer with Insights and guides customers through the purchase process.

Where a core performer focused on their own actions risks misreading or even misleading their customers, a Challenger removes subjectivity from their analysis by going straight to the source. In short, the Challenger wins by focusing on the Challenger customer.

Winning the Challenger Sale with the Challenger Customer

As with all Challenger behaviors, identifying and learning to work with Mobilizers takes time and practice. If this article is the first step in your journey, know that we view sales as part of the ongoing customer experience rather than a goal to be achieved or a single transactional moment in time. We’re pushing the vision of “The Challenger Sale” forward by exploring the latest developments in sales and marketing through expert interviews in our Winning The Challenger Sale webinar series and on our podcast.

Join us there, and take the next step in your Challenger journey.