Sales forecast accuracy is something everyone wants, and, it seems, no one can truly get.

Forrester rated the forecast accuracy of organizations whose sales projections fell within a 5% margin of error as excellent and those who performed within 10% as good.

But that level of accurate sales predictions proves elusive for most sales leaders. In its 2024 Sales Forecasting Benchmark Report, Xactly found that just 20% of sales organizations achieved forecasts within 5% of projections. 43% reported sales forecasts that missed goal by 10% or more.

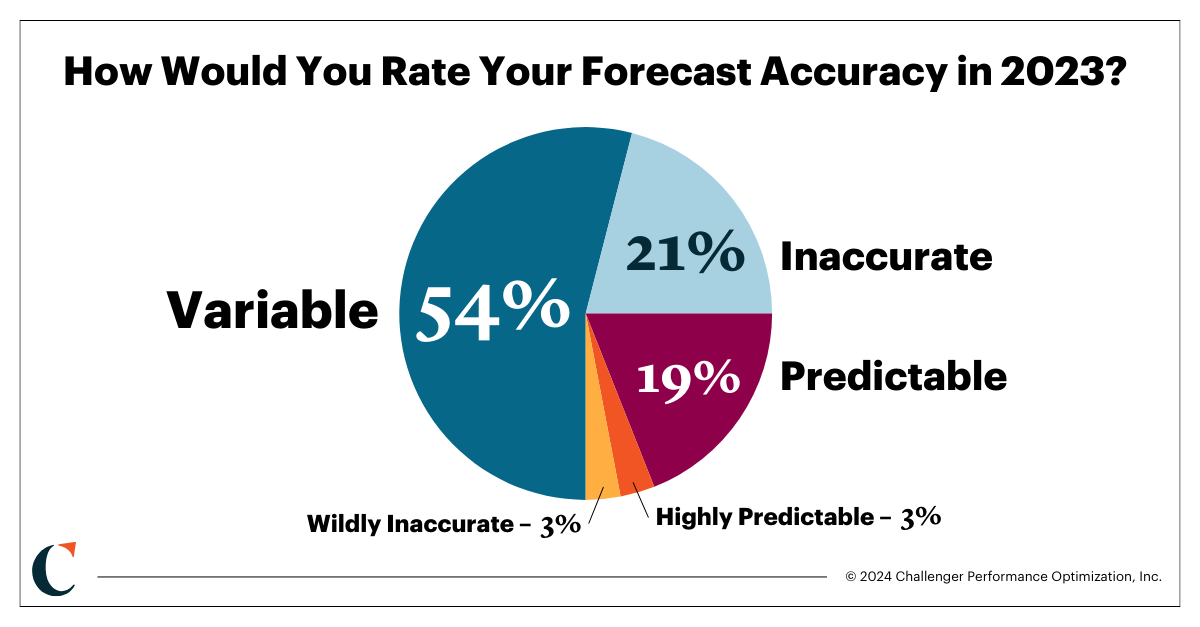

Additionally, fewer than 43% of sellers reported achieving quota attainment in Q2 2024, according to RepVue’s Cloud Sales Index — a decrease of 8% over the last two years. While RepVue’s data only covers SaaS companies, their research aligns to something we’ve heard repeatedly from clients across industries and verticals: sales and customer success leaders struggle deeply with sales forecasting. In a poll Challenger conducted in January 2024, less than 20% of sales leaders rated their sales forecast accuracy as “predictable.”

This lack of predictable sales projections is more than just spreadsheet jockeying. Inaccurate sales forecasts result in missed sales goals, which lead to missed revenue, snowballing into layoffs or budget cuts, resulting in less investment in current customers and less customer acquisition.

That inaccurate sales forecast snowball expands into an avalanche that no sales leader can afford to find themselves in, ultimately driving lost confidence from leadership and, even worse, lost customers and lost acquisition.

But sales forecast accuracy is as much science as art — and to improve sales forecast accuracy, sales leaders need to understand common mistakes in sales forecasting and follow Challenger’s best practices for accurate sales forecasting.

What is forecast accuracy?

Let’s start by defining sales forecasts and sales forecast accuracy, which measures how close a sales organization comes to predicting its sales performance in both the long and short term.

Creating an accurate sales forecast can include:

- The amount of sales pipeline your organization expects

- How much of that pipeline converts to opportunity

- The size of a potential deal and the timeline in which your sellers expect to close those deals

- Total closed-won business and expected sales revenue

What are the most common mistakes in sales forecasting?

Teams struggle to improve forecast accuracy for a host of reasons, old and new.

First, sellers face rising levels of customer indecision. Research into more than 2.5 million sales calls, conducted in 2020 and published in “The JOLT Effect,” found that 90% of those calls contained markers of customer indecision. What do we mean by indecision? While it often shows up as the dreaded cold feet at the end of a deal cycle, customer indecision in fact rears its head early in a sale, often in ways that lengthen cycles and make it harder to forecast a close. In fact, win rates are negatively correlated to levels of indecision.

Second, buying groups skyrocketed in the past few years, bringing infighting and conflicting approaches to buying along with them. Our research showed that the average number of stakeholders in a B2B buying team grew to an average of between six and 11, with more complex sales involving more stakeholders. A 2023 study from 6Sense found an average of nine members on B2B buying teams.

Next, there’s buyer behavior. Sellers fight over the scraps of an increasingly narrowing slice of customer mindshare. According to Gartner research, buyers only spend 17% of their buying time meeting with vendors. That’s all vendors, including a company’s competitors — and they like it that way. Seventy-five percent of buyers told Gartner that they wanted a completely rep-free experience.

How do you recognize the signs of inaccurate sales projections?

There are a few specific, evergreen challenges that sales leaders need to recognize and understand will negatively impact sales projections, resulting in inaccurate sales forecasts:

- Inaccurate data in the CRM

- Assuming a verbal “yes” means a signed contract and closed-won business

- An inconsistent sales process

- Sales managers who take differing approaches to sales forecasting

- The dreaded happy ears

- Unpredictable macroeconomic issues

Yet these common mistakes in sales forecasting are more symptoms than the underlying issue. And sales leaders who want to move themselves toward improved sales forecasting need to address the root causes — and they need to address them in the right way.

Sales forecast pitfalls to avoid

When sales leaders face a problem as widespread, and with as terrifying consquences, as inaccurate sales projections, they often pursue tactical, short-term fixes.

But just as American poet Taylor Swift once noted, “Band-aids don’t fix bullet holes,” short-term fixes that fail to address the root causes of inaccurate sales forecasts won’t stop the ongoing challenges that sales leaders face.

Mistake no. 1: Draining leadership time on seller activities

When sales forecasts vary widely from expectation, sales leaders will focus on results at a deal level, implement a complicated qualification framework like MEDDPICC or BANT, or perhaps add more fields to the CRM — and then spend their time following up to discover sellers never filled out that unnecessary data or used that new qualification framework. All of that time-consuming work should sit with sellers, and it brings sales leaders nowhere near producing more accurate sales forecasts.

Mistake no. 2: Overindexing on discounting

Cutting pricing will erode profit margins and devalue products. Ultimately, those discounts likely just save a deal that never should have been included in a sales forecast. They can also challenge retention and negatively impact the customer experience.

Mistake no. 3: Adding too much cushion to sales projections

No one likes to have their time wasted or feel misled. When sales leaders add too much cushion to sales projections, they open themselves up to outsized scrutiny from their board or senior leadership and set false expectations for their teams. This makes it more difficult for leadership to trust the data a sales leader brings to them. It demoralizes sellers and sales managers, too, who feel like they’re always chasing a number that truly does not exist.

To bring an organization to that magic number — less than 10% variance from a sales forecast — sales leaders must focus on addressing the underlying reasons that cause sales prediction mistakes.

That means turning focus earlier in the sales process, understanding the buyer types who help and hinder a sale, and using artificial intelligence to validate the data behind your sales forecasts.

Best practices that lead to accurate sales forecasting

Just as there’s no such thing as a 100% accurate sales forecast, there’s no single forecasting tool or one-step solution that can solve this issue.

Sales leaders instead need to enhance sales prediction accuracy by digging into how sellers and managers analyze their deals, including who they sell to, how they judge progress and track markers of indecision, and the tools they use to score it all.

Train sellers to identify Mobilizers

Challenger sellers learn to take a hard look at the members of their buying group and ask whether they’re Mobilizers or Talkers. This step is crucial for improving the accuracy of your forecasts, because while Mobilizers can move deals forward, Talkers are all mouth and no movement.

A Talker readily shares information but focuses only on themselves. You’ll know them by their use of “I” statements, willingness to answer every call and email, and tendency to go along with every suggestion. You might also recognize them when your deals start to fall apart because Talkers lack the internal capital to drive decisions forward.

Mobilizers, in contrast, exhibit healthy skepticism. They are far more thorough – which can mean more intense work upfront for sellers – because they know the value of building consensus in a buying group. While they might seem more difficult to deal with, this is exactly the behavior that lets us know that Mobilizers can be relied upon to drive decisions forward.

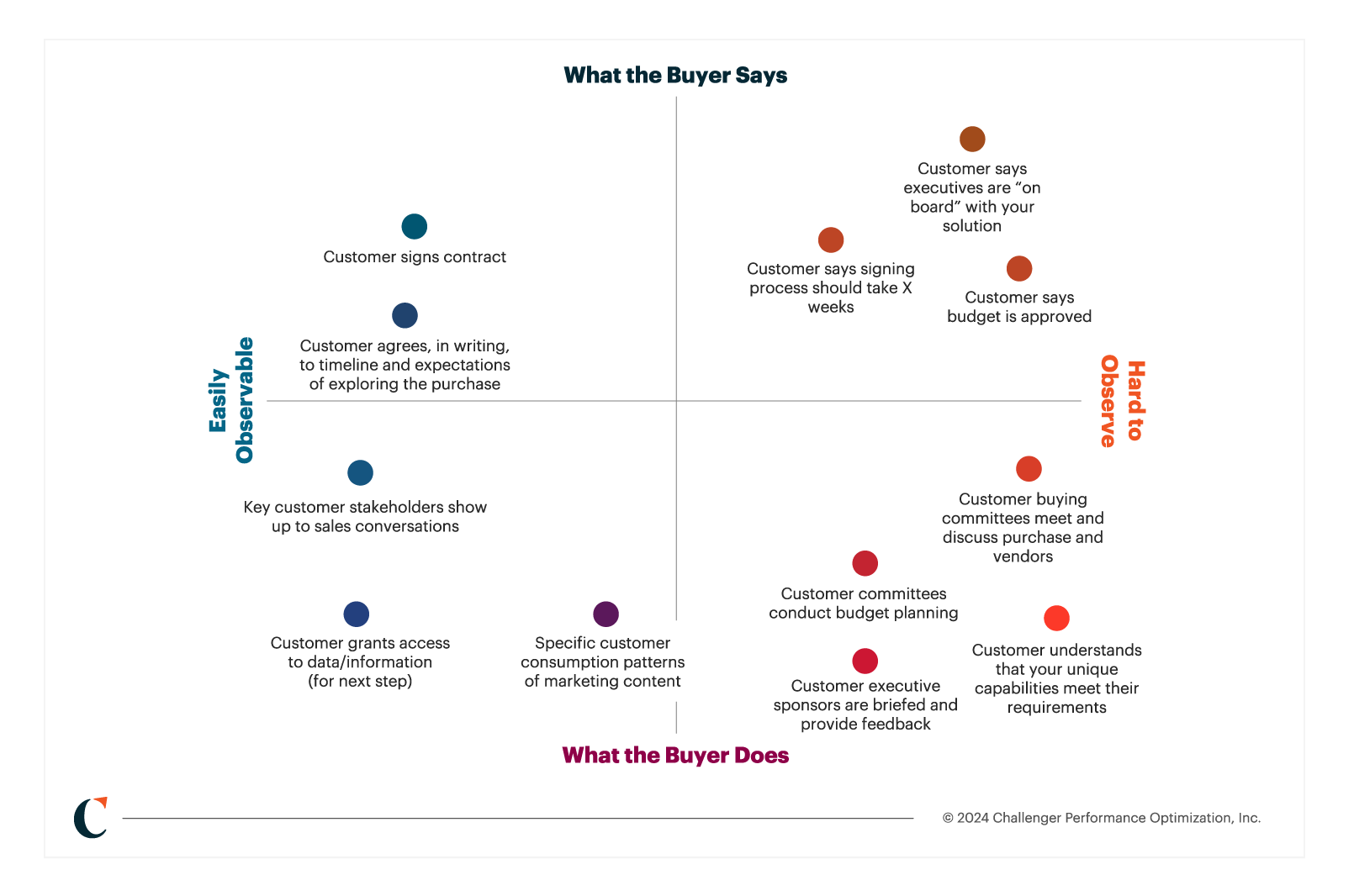

Sellers and managers motivated to improve forecast accuracy need to focus on what the buyer does, not what they say. Truly indicative factors – those that you can hang a forecast on with certainty – will show up as customer actions, not customer words. These actions can often be difficult to observe because they may take place behind the scenes. That’s where the Powerful Question comes in.

To achieve sales forecast accuracy, close the gap between what customers say and what they do

It’s impossible to predict whether a deal will close without sufficient information.

Often, when those difficult-to-observe behaviors are at play, sellers need to know more about what’s going on behind the scenes. To pull out those answers and accurately predict when a deal will close, your sellers must learn to ask Powerful Questions.

This means going beyond the status quo questions to dig deeper, ask for more specificity, and even ensure customers (who may be new to a complex sales process) have considered all potential Blockers to a sale. This is the key to closing the gap between what customers say and what customers actually do, which addresses the root of inaccurate sales forecasting.

Powerful Questions for sellers that lead to stronger sales projections

- “Will [exec sponsor] approve this initiative?” becomes “Does [exec sponsor] have a clear understanding of the ROI of this investment?

- “Who else needs to be involved?” becomes “Typically our clients need CFO approval for a purchase of this size. Is your CFO aware of this investment?”

- “Can we commit to a signing date of XX in order to hit XX milestone?” becomes “In order to begin on time, we need to finalize the agreement by XX date. Are your procurement and legal contacts aware of that deadline, and are they committed to meeting it?”

For the same reasons, sales leaders should be asking powerful questions of their sellers. This level of accountability helps sellers get realistic about deal forecasting.

Powerful Questions for sales managers that lead to stronger sales projections

- “Do you have executive sign off?” becomes “Do all executive stakeholders know they are in an active buying process? How did they respond to this investment?”

- “Do you have the right stakeholders involved?” becomes “Who is weighing in on this buying decision? Who have you spoken to? Who is still in the background?”

- “Has the client committed to a signing date?” becomes “How well do you feel your contact understands the approval and purchasing process? What is your confidence level that they’ve aligned all key stakeholders around signature by the committed date?”

Help sellers spot and address customer indecision

Crucially, research from “The JOLT Effect” shows that top-performing reps can judge the level of indecision in a deal early enough to proactively address concerns, push out its forecasted close, or disqualify the opportunity altogether. Sellers skilled in this approach more deals with a high likelihood of closing on time into their pipelines. They don’t experience last-minute cold feet at the same rate because they spot and address customer indecision long before it can derail their deals. Imagine how an organization-wide understanding of customer indecision could affect future sales forecasts.

Understand how buyer verifiers influence sales projections

Buyer verifers are signals that buyers give that indicate whether they want to move forward in a deal cycle. This is why it is incredibly important that sellers accurate gauge what buyers plan to do — not simply report what they say. It is what a buyer does that moves them forward in the sales process. When sellers observe and accurately capture the signals that buyers give, this allows sales leaders to produce more accurate sales forecasting.

Tools for improving sales forecast precision

For accuracy and repeatability, sales leaders need a systemic approach to better forecasting. That means equipping managers to ask the right questions. They should know not just to inspect seller performance, but what to look for, using Powerful Questions to probe for an unvarnished view. They should know how to coach sellers to identify Mobilizers and limit the influence of Talkers and Blockers, and above all, how to use these signals to accurately forecast when their own sales will close — or to know when to walk away.

Because forecasting is a team sport, improved forecast accuracy requires organization-wide change. Sales leaders must analyze sales forecasting culture to ensure the entire team approaches it thoughtfully and not as fire drills. How often the organization produces sales forecasts should be intentional and widely-known; many sales organizations forecast on a weekly, monthly, or quarterly basis and in many cases, they produce sales projections across all three time periods. Forecast accuracy should be an objective up and down the org chart, from frontline sellers to the CRO.

Most organizations need to operationalize improving forecast accuracy in one, or a blend, of three ways.

- Manually Small organizations on a tight budget might decide to bootstrap their forecast accuracy. In this case, organizations will spend more time training their reps to notice signals of indecision, vetting their contacts for signs they’re a Mobilizer, and drilling on Powerful Questions. They may choose to use “report cards” and other deal inspection processes to develop their forecasts. Even a manual approach can improve forecast accuracy when it’s delivered with rigor and dedication.

- In a CRM Building deal inspection into your existing CRM streamlines the forecast accuracy process for sellers and removes an element of human error from your analysis. For instance, RevOps teams might tag buyer profiles such as Mobilizers, Talkers, and Blockers in Salesforce. Sellers can use additional buyer verifiers throughout the life of the deal, building a reliable and accurate timeline with less room for error, producing sales projections that are far more accurate

- Using AI Conversational intelligence tools use artificial intelligence to observe, record, and flag buyer behavior without bias. Tools such as Gong ingest data from conversations over the life of a deal to verify progress against sales forecasts more accurately. They eliminate the human error and “happy ears” that sneak into any well-meaning deal inspection. At Challenger, we’ve seen markedly higher win rates over traditional deal inspection after implementing AI buyer verifiers in our own sales process, both in our CRM and using conversational intelligence.

To improve forecast accuracy, go back to the beginning

Improving forecast accuracy is not about when an organization forecasts, but how sales leaders forecast for their business:

- Sellers must understand who they’re selling to, the forces stacked against them, and how to ruthlessly prioritize the deals they need to close, then accurately report them so the forecast contains accurate sales projections.

- Managers must know how to ask the right questions and coach their sellers toward the right targets and coach sellers on how to uncover buyer verifiers.

- Organizations must commit to a standardized, repeatable process using manual or AI-equipped tools.

It isn’t glamorous, but the results for improved sales forecast accuracy are clear. Organizations that equip their sellers and managers with the skills to verify and vet deals reap the benefits of more accurate sales forecasts.

Challenger, Inc.

Challenger is the global leader in training, technology, and consulting to win today’s complex sale. Our sales transformation and training programs are supported by ongoing research and backed by our best-selling books, The Challenger Sale, The Challenger Customer, and The Effortless Experience.

More from our blog

Challenger’s guide to sales transformation

Key takeaways Challenger’s approach to driving predictable revenue and sustainable growth is known as commercial transformation Transformation goes…

Strengthen Your Coaching Skills with Challenger’s PAUSE Framework

There’s only one seller productivity investment endorsed as more important than all others by Matt Dixon and Brent Adamson, authors of “The…

Richardson and Challenger named a Top 20 Sales Training Company

Richardson and Challenger celebrate its selection today as one of Training Industry’s 2025 Top 20 Training Companies™ for the Sales Training and…

What are you waiting for?

Transform your sales team.

The best companies grow, and grow fast, by challenging customers, not by serving them.