Since we began tracking B2B buying behavior more than ten years ago, the market, technology, and buying cycles all ballooned in complexity. Yes, your dad is right: everything used to be a lot less complicated. Anecdotally, we hear that sellers face significantly increased pressure to perform even as sales cycles elongate and new procurement processes take hold. Our ongoing research into customer behavior illuminated this in detail.

We also noticed that a painstaking customer buying process and a more difficult economic environment increasingly resulted in what we call “purchasing gridlock.” One major problem — the growing size of the B2B buying group — helps explain why your once-healthy pipeline highway now looks like a parking lot. Your sellers need to understand what customers want, and why sharpening their skills can clear the congestion.

Tracking growth in the average B2B buying group

In 2019, Challenger surveyed a large sample of B2B buyers and asked them to reflect on recent large purchases that included an interaction with a seller. The study aimed to see what, if anything, changed regarding buying behavior and drivers of loyalty since the original research.

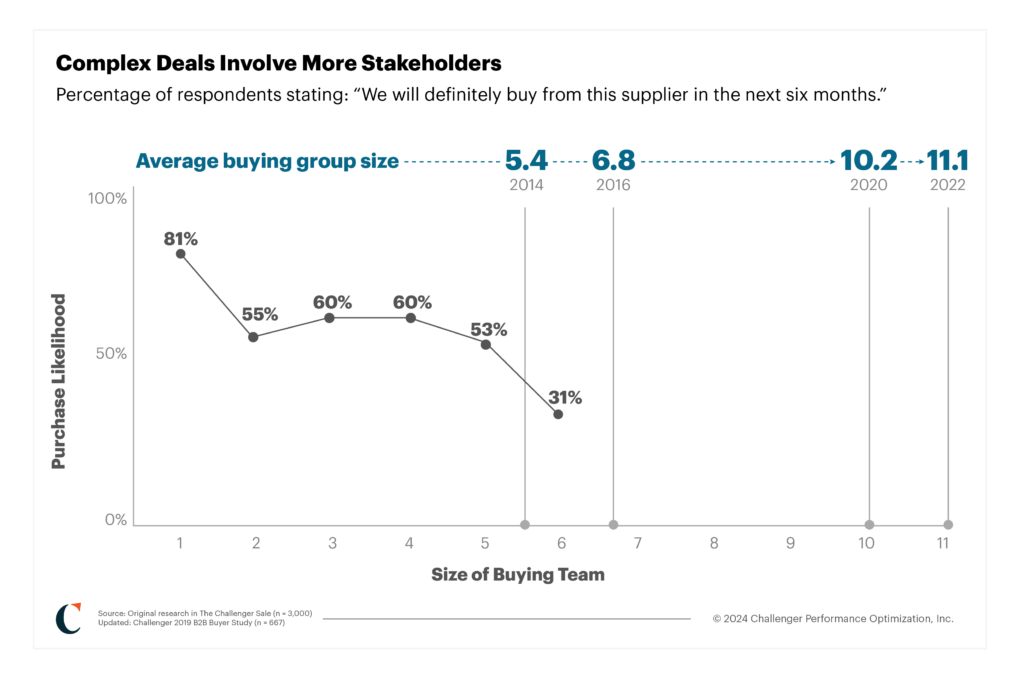

While the research uncovered that many of the drivers of loyalty remained the same, it also revealed major developments in the size of buying groups. Specifically, the typical B2B buying group roughly doubled. When we track changes over time, we see it increase incrementally every few years from 5.4 in 2009 to 6.8 to 10.2 to just under a dozen in 2019.

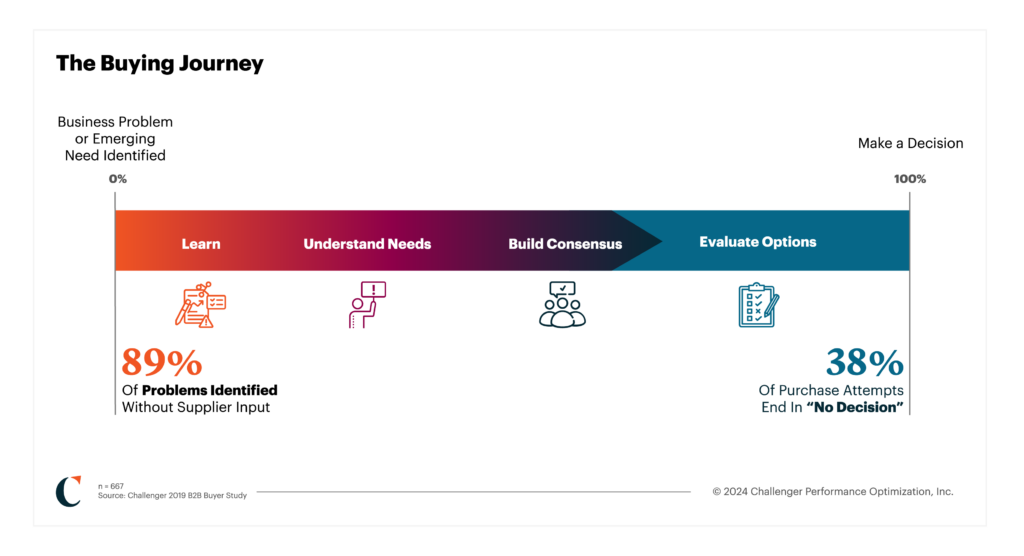

Challenger also found in 2019 that up to 38% of customer purchase attempts end in “no decision.” In other words, nearly 4 out of 10 would-be buyers in the study started a purchase process only to quit before deciding to change anything. In “The JOLT Effect,” authors Matt Dixon and Ted McKenna found medium-high levels of indecision present in nearly 90% of complex deals and that no decision loss accounts for 40-60% of all lost deals.

Together, this makes for an alarming development for sellers.

How economic realities contribute to B2B buying gridlock

The global economy slowly but steadily improved after the 2008 global financial crisis, which meant booming headcounts and investments. Then, in the early days of 2020, we saw major investments in technology as companies accelerated their digital transformations and accommodated remote work.

As companies looked to stabilize through the will-it-recede-or-won’t-it pandemic years of 2020-2024, they implemented stronger controls through functions such as procurement. Many buyers saw their budgets tightened or eliminated altogether. Then, as teams redistributed resources to meet demands, the question of “who owns what” led to an even squishier sales process.

Now, the typical B2B purchase process might involve a dozen people from several different departments and time zones. Selling a solution touching stakeholders across expanding go-to-market teams, for example, might involve gaining buy-in from VPs in three departments, individual stakeholders from operations to sales to marketing, and a chief revenue officer – as well as legal, procurement, and implementation teams.

Our virtual reality

Our research shows that buyer behavior and how sellers respond changed significantly after the pandemic. All that investment in emerging technology transformed our working conditions, making it easier than ever to invite new stakeholders to the (virtual) table. And while aligning calendars might seem easier with Outlook and GoogleCal, this pattern presents its own challenges for buyers and sellers when it comes to wrangling consensus from the buying group.

Customers may face the expectation of including more internal “experts” in every sale, which means building more consensus. Unless managers and sellers are trained to handle these large, complex, multi-stakeholder deals, they may be unprepared to push the deal forward. Remote work also complicates the landscape; when sellers can’t walk into an office, it can feel impossible to identify the real size and shape of the B2B buying group. The net effect is a shift toward many-to-many sales where sellers must coordinate many internal stakeholders to address the needs of many customers.

How gridlock contributes to no-decision losses

Challenger sellers know that identifying buyer types is a key part of an effective B2B sale. But in this environment, sellers struggle to tell Talkers and Mobilizers apart. They may also fail to address the concerns of Blockers effectively. With so much of the purchase process taking place behind closed doors, sellers can find themselves listening with “happy ears” and projecting a sale to close – only to find that it stalls in the final mile because someone in the buying group developed cold feet.

With so many voices and needs at play, gaining consensus is harder than ever before. In “The JOLT Effect,” Dixon and McKenna defined three roots of indecision. Buyers struggle to agree with each other, and in fact, each may bring a different concern (or a mix of them) to the deal – resulting in multiplying, compounding, ongoing indecision.

- Choice overload happens when prospects fail to prioritize their needs – or the needs of competing stakeholders. As buying groups multiply, those needs may compete so intensely that they simply cancel each other out, leading to a no-decision loss.

- Information overload occurs when sellers blindly send resources to their buyers instead of curating them to address their specific concerns. For sellers, the key moment lies in recognizing the tipping point between helpful answers and information overload. With large, opaque buying groups, this may be particularly difficult.

- Expectations overload stems from a lack of trust, either in the outcomes the seller presents as possible or in their company’s ability to achieve them. If internal politics, difficult procurement processes, or past failed implementations are on their minds, members of a B2B buying group may balk.

In reality, the signs of looming indecision often present themselves in a sale cycle from the very first call. To effectively overcome indecision, sellers must recognize and respond to those cues throughout the sales process, and that comes down to building seller skills.

Developing seller skills solves gridlocked buying

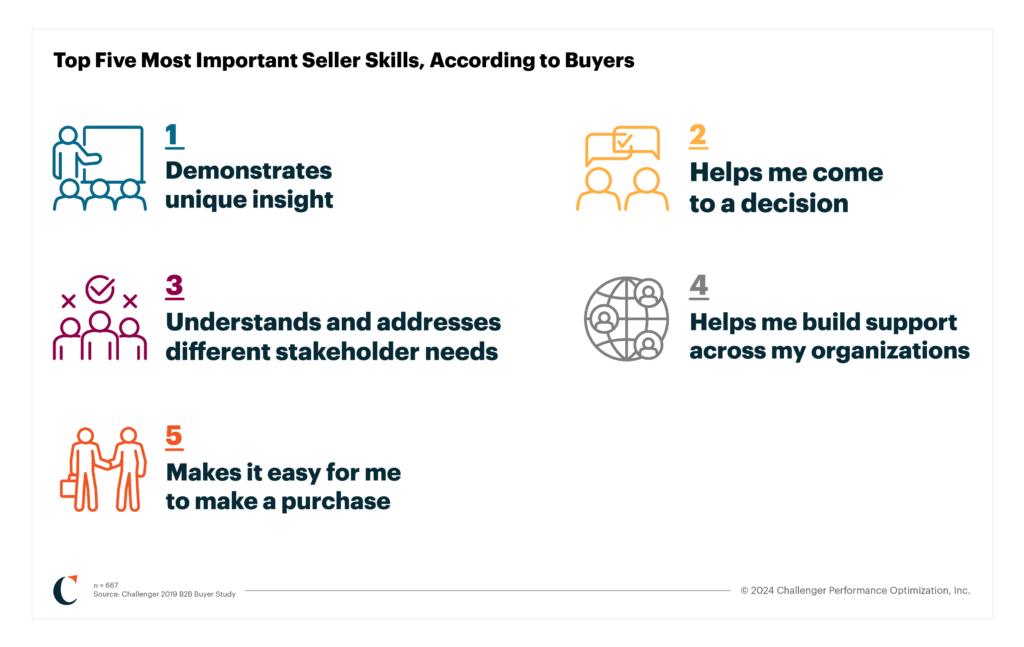

It’s up to sales leaders to educate their sellers with the tools and skills they need to successfully engage and close deals with large buying groups. Again, we can turn to our 2019 buyer survey, which reveals that the increasing size of B2B buying groups isn’t just a headache for sellers, but for customers, too. Customers need support to help them navigate these challenges, and the wisest sales organizations are equipping sellers and their managers with new skills aimed at this new sales challenge.

While some sellers may struggle to wrangle a large buying group, truly skilled sellers approach the purchase process with a commercial insight specifically designed to position them as trusted advisors. They come armed with the experience and skills necessary to guide buyers through the purchase process – including helping them make decisions using an updated playbook, addressing different stakeholders’ needs, and building support across the organization. Building and enforcing these skills in frontline sellers and sales leaders enables organizations to clear the congestion in their pipelines and avoid new gridlock before it begins.

Challenger, Inc.

Challenger is the global leader in training, technology, and consulting to win today’s complex sale. Our sales transformation and training programs are supported by ongoing research and backed by our best-selling books, The Challenger Sale, The Challenger Customer, and The Effortless Experience.

More from our blog

Challenger’s guide to sales transformation

Key takeaways Challenger’s approach to driving predictable revenue and sustainable growth is known as commercial transformation Transformation goes…

Strengthen Your Coaching Skills with Challenger’s PAUSE Framework

There’s only one seller productivity investment endorsed as more important than all others by Matt Dixon and Brent Adamson, authors of “The…

Richardson and Challenger named a Top 20 Sales Training Company

Richardson and Challenger celebrate its selection today as one of Training Industry’s 2025 Top 20 Training Companies™ for the Sales Training and…

What are you waiting for?

Transform your sales team.

The best companies grow, and grow fast, by challenging customers, not by serving them.