Buyers leave vendors out of problem identification 90% of the time.

Recently, we discussed how buyers go out of their way to limit the number of potential vendors involved in a buying decision. In their final selection process, they prefer to choose among no more than three or four. To have a shot at winning, it’s critical for vendors to impress early and win a seat at the table.

This week, we take a closer look at the process buyers use to make this selection and, specifically, how the process begins.

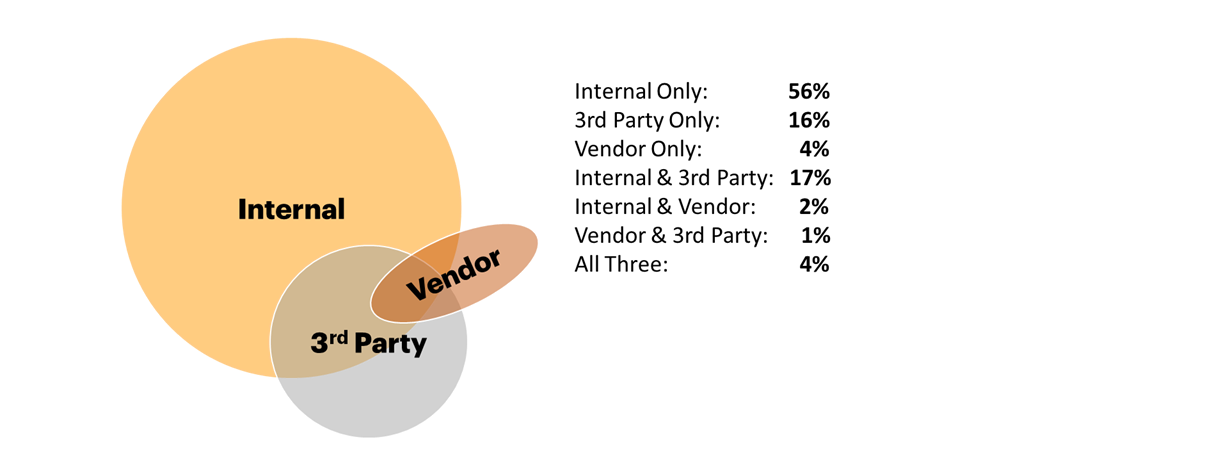

Let’s look at how buyers identify an initial need or problem in their business; one that motivates them to seek a solution and ultimately a purchase. The data below comes from a recent study of 667 buyers, working at large companies (all with at least 200 employees and 42% with more than 2,000 employees). We asked these buyers to think of their most recent purchase. We then asked them to select which stakeholders helped them identify the initial problem the purchase intended to solve. Stakeholders fell in three categories: Internal, Objective 3rd Party, and Potential Vendor. The answers form the Venn diagram below:

Stakeholders Involved In The Most Recent Purchase

Vendors only played a role in problem identification 11% of the time. Almost 9 times out of 10, the buyer formed an understanding of their business problem either on their own, or with a 3rd party, but disconnected from the people they ultimately tasked with providing the solution to that problem.

Sellers need to get in early.

We’ve spoken for years about the 57% statistic – that buyers are about 57% of the way through their buying journey before proactively engaging vendors. The 57% number is somewhat arbitrary, but it establishes the point that buyers have a tendency to do much of their initial problem identification and solution research on their own. The findings above deepen this story by telling us just how often this is the case.

Why is this a problem?

For this simple reason, “the customer may not always be right.” Complex B2B purchases often involve buying something for the first time (a new technology, a new process, a new support resource to scale). What if the problem isn’t properly diagnosed? What if important elements are de-prioritized? The customer’s perspective might be off 5 degrees or 180 degrees. Either way it’s off. And like traveling to the moon, if you miscalculate a few degrees at the beginning of the journey, you miss the destination by a long shot.

What happens when the customer’s flawed perspective is left unchecked? A disconnect forms between what the customer thinks they need and what vendors can supply. This can be frustrating; customers feel forced to settle for something that doesn’t quite fit – “a compromise sale.” The buying group finds it harder to reach consensus and quite often – after wasted time, effort and money – disbands when no solution suits.

Buyers are not likely to change their ways any time soon. The old saying applies well, “they may be wrong, but are never uncertain.” The responsibility to change this dynamic falls to sales and marketing teams, who must work together to influence emerging demand, rather than react to established demand.

This is done with powerful commercial insight, or messages that make the customer think differently about the problem right at the outset. That message must have sound reason and emotional resonance to Reframe customer thinking and begin a direct path to the vendor’s differentiated solution. How it’s delivered is critical and to whom it’s delivered is also critical. If done right, it gives the customer an easier, more successful buying journey and a more satisfying solution. Sellers convert more deals, and do so faster. Everyone wins.

In today’s environment, one of the worst things a vendor can do for customers is to let them risk getting the problem wrong. The buying group may never recover.

Challenger, Inc.

Challenger is the global leader in training, technology, and consulting to win today’s complex sale. Our sales transformation and training programs are supported by ongoing research and backed by our best-selling books, The Challenger Sale, The Challenger Customer, and The Effortless Experience.

More from our blog

Challenger’s guide to sales transformation

Key takeaways Challenger’s approach to driving predictable revenue and sustainable growth is known as commercial transformation Transformation goes…

Strengthen Your Coaching Skills with Challenger’s PAUSE Framework

There’s only one seller productivity investment endorsed as more important than all others by Matt Dixon and Brent Adamson, authors of “The…

Richardson and Challenger named a Top 20 Sales Training Company

Richardson and Challenger celebrate its selection today as one of Training Industry’s 2025 Top 20 Training Companies™ for the Sales Training and…

What are you waiting for?

Transform your sales team.

The best companies grow, and grow fast, by challenging customers, not by serving them.